Introduction: The Rise of UPI Apps in India

India’s digital payment revolution has transformed how people handle money. At the center of this transformation is the UPI App, a system that enables instant, secure, and cashless transactions directly between bank accounts. Whether you are sending money to a friend, paying for groceries, booking travel, or managing business payments, UPI apps make the process fast, simple, and reliable.

The Unified Payments Interface has eliminated the need for cash, long bank queues, and complicated transfer processes. With just a smartphone and a bank account, users can complete transactions in seconds. This ease of use, combined with strong security and zero or minimal transaction costs, has made UPI apps an essential part of everyday life across India.

This guide explains what a UPI app is, how it works, why it is safe, and how it supports a fully cashless payment ecosystem.

What Is a UPI App?

A UPI app is a mobile application that allows users to send and receive money instantly using the Unified Payments Interface. Instead of entering bank details like account numbers and IFSC codes, users transact using a simple Virtual Payment Address (VPA) or mobile number.

UPI apps are regulated and operated under the supervision of National Payments Corporation of India, ensuring reliability, transparency, and standardization across all participating banks and apps.

Popular UPI apps integrate multiple banking services into one platform, enabling users to:

- Transfer money instantly

- Pay merchants and utility bills

- Request payments

- Manage multiple bank accounts

- Track transaction history in real time

How a UPI App Works

Understanding how a UPI app works helps users trust and use it confidently. The process is designed to be user-friendly while maintaining strong security standards.

Step 1: App Installation and Registration

Users download a UPI app from an authorized app store. During setup, the app verifies the mobile number linked to the user’s bank account.

Step 2: Bank Account Linking

The app automatically detects eligible bank accounts connected to the mobile number. Users select their bank and create a UPI ID.

Step 3: UPI PIN Creation

A secure UPI PIN is created for transaction authorization. This PIN is known only to the user and is required for every transaction.

Step 4: Making a Transaction

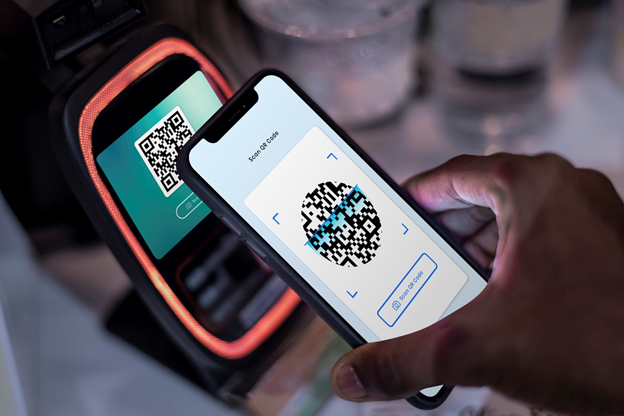

To send money, users enter the recipient’s UPI ID, mobile number, or scan a QR code. After entering the amount, the transaction is authorized using the UPI PIN.

Step 5: Instant Settlement

Funds move directly from the sender’s bank account to the recipient’s account in real time, available 24/7.

Why UPI Apps Are Simple to Use

One of the biggest reasons for UPI’s popularity is its simplicity. The system removes traditional barriers associated with banking transactions.

No Complex Bank Details

Users do not need to remember account numbers or IFSC codes. A simple UPI ID or QR scan is enough.

User-Friendly Interface

Most UPI apps are designed for all age groups, including first-time digital users. Clear menus, large buttons, and simple language make navigation easy.

One App, Multiple Banks

A single UPI app can link multiple bank accounts, allowing users to manage all finances in one place.

Security Features of UPI Apps

Security is a top priority in UPI transactions. Every layer of the system is designed to protect user data and funds.

UPI PIN Protection

Each transaction requires a unique PIN, ensuring unauthorized users cannot access funds.

Two-Factor Authentication

UPI follows two-factor authentication, combining device verification and PIN authorization.

Bank-Level Encryption

All transactions are encrypted using advanced security protocols approved by banking authorities.

Real-Time Alerts

Users receive instant notifications for every transaction, allowing quick action if something seems unusual.

Cashless Payments and Financial Inclusion

UPI apps have played a major role in promoting financial inclusion across India. From metropolitan cities to rural villages, UPI enables people to participate in the digital economy.

Accessibility

Anyone with a basic smartphone and bank account can use UPI, removing dependence on physical banking infrastructure.

Empowering Small Businesses

Street vendors, small shops, and service providers can accept digital payments easily using QR codes.

Reducing Cash Dependency

By minimizing cash usage, UPI apps reduce theft risk, improve transparency, and streamline daily transactions.

UPI Apps for Everyday Payments

UPI apps support a wide range of daily payment needs:

- Grocery and retail shopping

- Online and offline merchant payments

- Utility bills and mobile recharges

- School and college fees

- Subscription services

- Peer-to-peer money transfers

This versatility makes UPI apps a complete digital payment solution rather than just a transfer tool.

Role of Banks and Payment Platforms

UPI apps operate in collaboration with Indian banks and authorized payment service providers. Some of the most widely used platforms include Google Pay, PhonePe, and Paytm.

These platforms provide the interface, while banks handle account authentication and settlement. This partnership ensures reliability and scalability.

Benefits of Using a UPI App

Instant Transactions

Money transfers happen in seconds, even on weekends and holidays.

Zero or Low Charges

Most UPI transactions are free, making them cost-effective for users.

24/7 Availability

UPI works round the clock without bank timing restrictions.

Transparency

Every transaction is recorded and easily traceable through app history.

Scalability

UPI supports millions of transactions daily without performance issues.

UPI Apps and the Digital Economy

UPI apps have become a backbone of India’s digital economy. They support:

- E-commerce growth

- Online service platforms

- Digital lending and credit solutions

- Government benefit transfers

- Subscription-based business models

This ecosystem strengthens economic activity while promoting transparency and accountability.

UPI for Businesses and Merchants

Businesses benefit significantly from adopting UPI apps:

- Faster payment settlement

- Reduced cash handling costs

- Simple onboarding process

- Easy accounting and transaction tracking

- Improved customer convenience

From large enterprises to local vendors, UPI enables seamless digital acceptance.

Common Use Cases of UPI Apps

- Sending money to family and friends

- Paying rent and utilities

- Shopping online and offline

- Booking travel and entertainment

- Managing recurring payments

These use cases demonstrate how deeply UPI apps integrate into everyday life.

UPI Apps vs Traditional Payment Methods

Compared to cash, cards, and bank transfers, UPI apps offer:

- Faster processing

- Higher security

- Lower operational costs

- Better user experience

- Wider acceptance

This advantage explains why UPI adoption continues to grow rapidly.

Challenges and How UPI Apps Address Them

While digital payments face challenges like fraud risks and connectivity issues, UPI apps address them through:

- Strong authentication protocols

- Continuous monitoring systems

- User education and awareness

- Improved network infrastructure

These measures help maintain trust and reliability.

The Future of UPI Apps

UPI apps continue to evolve with new features such as:

- International payments

- Voice-based transactions

- Integration with smart devices

- Enhanced fraud detection systems

These innovations will further strengthen UPI’s role in a cashless economy.

Conclusion

The UPI App has transformed digital payments by offering a simple, secure, and fully cashless way to manage money. With a UPI App, users can send and receive funds instantly, pay bills, shop online or offline, and complete everyday transactions without relying on cash or cards. The ease of using a UPI App, combined with real-time processing and strong security features, makes it one of the most trusted payment methods in India.

As digital adoption continues to expand, the UPI App will remain a core part of modern financial activity. From individuals to businesses, the UPI App supports faster transactions, better transparency, and seamless financial access. By enabling safe, instant, and cashless payments, the UPI App continues to drive India toward a smarter and more connected digital payment ecosystem.