Cryptocurrency trading was once a simple manual process of buying and selling. With the advent of DeFi, the need for automation, precision, and speed grew enormously. Traders want bots that execute trades in an efficient time to capitalize on whichever opportunity pops up in real-time while eliminating any emotional sentiment related to decision-making. Of these technical innovations, the Jupiter crypto trading bot is a premier automation solution designed to extract maximum performance within the Jupiter ecosystem. It is built to spot market trends and trade down into the finest details, thereby enabling the novice and expert alike to comfortably and consistently trade with confidence through the wild and volatile crypto markets.

Know the Essence of the Jupiter Ecosystem

Recognized commonly as being one of the most novel blockchain initiatives in the areas of data privacy and decentralized communication, Jupiter is working toward financial domains. Jupiter seeks to ensure that any blockchain solution is secure, transparent, and accessible. It ranges from secure messaging to decentralized trading. The Jupiter crypto trading bot is at the core of the ecosystem, offering users an automated way to trade based on a set of trading strategies for supported tokens, among which are the native JUP and some big cryptocurrencies. This integration ties the core intent of decentralization in Jupiter with the modern demand of traders for efficiency and control.

What Is the Jupiter Crypto Trading Bot?

The Jupiter crypto trading bot tries to automate the process of buying and selling cryptocurrencies on supported exchanges. Considering already set rules and algorithms, it executes trades on the basis of market signals, ensuring trades react to changes way faster than any human ever could have. The bot looks at price changes, technical indicators, and volume data period by period to respect criteria and executes trades. Traders then go on and tweak this utilization according to their own risk tolerance—from conservative portfolio management to high-frequency trading strategies. This allows the bot to serve the potential maximization of profits while limiting emotional errors from the human side.

How the Jupiter Crypto Trading Bot Works

At the most basic level, the Jupiter trading bot uses sophisticated algorithms with API integrations with crypto exchanges. The user connects his exchange account to the bot via secure means and sets values for trade entry, stop, and take profit levels, and the bot handles the rest. The system waits for market conditions, adjusting orders according to the user’s strategy. Some variations even include machine learning modules that increase prediction accuracy by considering past and real-time market data. Simply put, it forms a 24/7 trader that misses no profitable opportunities and preserves efficiency during volatile market hours.

Advantages of Using Jupiter Crypto Trading Bot

The Jupiter crypto trading bot comes with many advantages that add to its goodwill among professionals and retail traders alike:

Around-the-clock Market Surveillance: It does not sleep and keeps an eye on potential trades going on in the market.

Emotion-Free Execution: Fear and greed should never influence a decision; only facts and logic should be at play.

Fast Execution and Precision: Executes in milliseconds, so slippage or missed opportunities are not an issue.

Backtesting: Users can test their strategies on past market data before trading live.

Diversified Strategies: Multiple bots can be deployed to trade different assets or follow diverse strategies.

Risk Management: Built-in stop loss, trailing stop, and take profit options help keep losses to a minimum.

Such automation, combined with ample power in hand, fulfills the essential element of giving the trader an advantage over the competition in an eventual competitive market.

Setting Up and Customizing the Bot

Connecting an exchange account through secure APIs and setting up trade parameters are typical steps to set up a Jupiter crypto trading bot. Usually, the software enables the choice of preset strategies or the development of custom ones based on indicators, such as RSI, MACD, Bollinger Bands, or moving averages. Once started, the bot will monitor live market data in real time and execute trades when price action meets the criteria outlined in the strategy manual. Giving real-time tracking of performance, the software then allows the trader to analyze the efficiency of a strategy and decide if any changes to enhance profits should be made.

Automation with a Role in Reducing Risk

Volatility is the chief hurdle in crypto trading. Prices can rally or sink within seconds, and a human trader may not be able to react that instant. Hence came Jupiter, a crypto trading bot that takes quick decisions to execute trades the instant signals get triggered. This means one will never risk violating risk management parameters, especially on impulsive decisions and errors leading to vast losses. By using automation and disciplined execution hand-in-hand, a trader can manage exposure and maintain steady performance through time.

Potential Risks and How to Mitigate Them

Of course, potential dangers exist despite the myriad benefits mesmerized through automation. The entire performance of the Jupiter crypto trading bot depends on market data and exchange APIs to function correctly, but incidents arise when these actually become disconnected, or there are some technical bugs along the way affecting performance. The following points are some of the ways to counter these risks:

Keep a keen watch on the activities of the bot; keep all the logs associated with it.

Extensively backtest strategies before live deployment.

Do not leverage excessively, nor trade with untested strategies in volatile markets.

Spread funds into several assets or exchanges.

Thus, if one can deploy strong risk management techniques, then that will make a good complement for proactive monitoring to yield long-term effectiveness of any automated system.

The Need for Better Portfolio Management

Automation is one arm working and another for analytics and tracking performance. This is where portfolio management platforms fit in. For Jupiter crypto trading bot users, integration with a dependable portfolio management tool ensures real-time visibility into profits, balances, and asset distribution while at the same time providing further insight into the performance levels of various strategies to educate their users on strategies that can perform better under given markets, thus following up and continuously adapting to the new market environment.

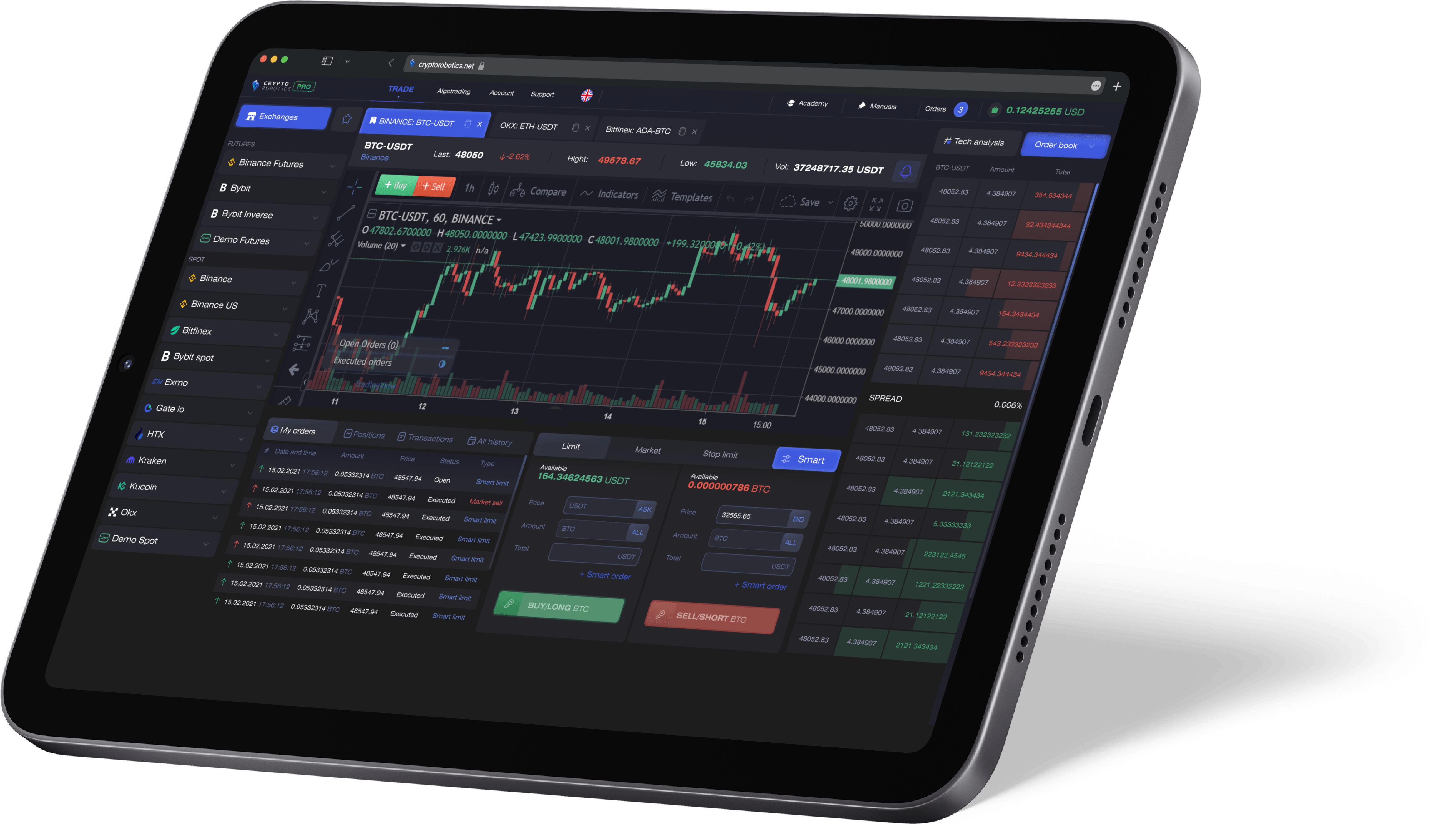

Meet GoodCrypto—A Better Trading Companion

Well, GoodCrypto is one of the most advanced crypto portfolio management and trading solutions today. It complements automation-type tools such as the Jupiter crypto trading bot perfectly. GoodCrypto lets you track all your crypto assets, trades, and profits across multiple exchanges and wallets in an easy-to-use, intuitive interface. The app supports more than 30 major exchanges and provides real-time analytics, so traders have control even when the trades are placed through bots.

Why GoodCrypto Makes a Perfect Partner for Bot Users

GoodCrypto shares tools with the Jupiter crypto trading bot and other tools such as

Smart Order Types: Set complex trades with trailing stops, take-profit, and stop-loss orders.

Real-Time Portfolio Tracking: Monitor balances, profits, and open positions at the drop of a hat.

Comprehensive Analytics: Assess bot performance, calculate ROI, and identify trends.

Instant Alerts: Stay notified of any change in price, execution of orders, or events in the markets.

Non-Custodial Security: The service never holds user funds or private keys for trade, ensuring that it is the safest way to trade.

This combination of analytics and automation gives traders the choice to make informed decisions while still having complete control over their portfolios.

The Evolution of Automated Trading

Jupiter cryptocurrency trading bot is a next-generation automation platform under the DeFi.

As AI and blockchain technologies evolve, trading bots will be even more adaptable, intuitive, and integrated into decentralized ecosystems. Future iterations of these systems might include AI-powered prediction models, on-chain data analytics, or cross-chain trading. These would be complemented by platforms like GoodCrypto that provide consolidated analytics and smooth portfolio tracking, allowing traders to compete in the ever-changing market.

Conclusion

Since the inception of automation, its presence in digital asset trading has transformed, with Jupiter’s crypto-trading bot at the forefront of this transformation. Being fast, consistent, and timely incites the necessities of the crypto market, which is a very volatile environment. GoodCrypto lets traders appreciate and maximize automation by extending its power for the execution of orders and running deep analytics with a real-time portfolio view. Both tools have worked toward crafting a trading world that is safe, smart, and efficient, thus heralding the dawn for decentralized finance and smart trading.