Introduction

The cryptocurrency market has evolved significantly, offering traders various instruments to amplify potential returns. Among these, margin and futures trading stand out as popular choices. These trading methods allow individuals to leverage their positions, potentially increasing profits. However, they also come with heightened risks. Understanding the platforms that offer these services, along with their features, is crucial for any trader looking to navigate this space effectively.

What Is Margin Trading?

Definition and Mechanics

Margin trading involves borrowing funds from a broker or exchange to trade a financial asset, allowing traders to open positions larger than their account balance. In the context of cryptocurrencies, this means using leverage to amplify potential returns.

Pros and Cons

Pros:

- Increased Profit Potential: Leverage allows traders to amplify their gains.

- Access to More Capital: Traders can control larger positions with a smaller initial investment.

Cons:

- Increased Risk: While profits can be amplified, so can losses.

- Margin Calls: If the market moves against a trader’s position, they may be required to deposit more funds to maintain the position.

What Is Futures Trading?

Definition and Mechanics

Futures trading involves entering into a contract to buy or sell an asset at a predetermined price at a specified time in the future. In cryptocurrency, this allows traders to speculate on the price movement of digital assets without owning the underlying asset.

Pros and Cons

Pros:

- Hedging Opportunities: Traders can protect their portfolios against adverse price movements.

- Leverage: Similar to margin trading, futures contracts often allow for leveraged positions.

Cons:

- Complexity: Futures trading requires a deep understanding of the market and contract specifications.

- Expiration Dates: Unlike spot trading, futures contracts have expiration dates, which can add pressure to close positions.

Top Crypto Exchanges Offering Margin and Futures Trading

Binance

- Leverage Options: Offers up to 125x leverage on futures contracts.

- Supported Assets: Supports a wide range of cryptocurrencies including Bitcoin, Ethereum, and Solana.

- Fees: Competitive fee structure with discounts for BNB holders.

Kraken

- Leverage Options: Provides up to 10x leverage on margin trading.

- Supported Assets: Offers over 150 margin-enabled markets.

- Security: Known for strong security measures and regulatory compliance.

Bybit

- Leverage Options: Allows up to 100x leverage on futures contracts.

- User Interface: Offers an intuitive and user-friendly interface.

- Liquidity: High liquidity ensures tight spreads and efficient order execution.

KuCoin

- Leverage Options: Provides up to 100x leverage on futures trading.

- Altcoin Support: Supports a wide variety of altcoins for margin and futures trading.

- Features: Offers features like copy trading and staking.

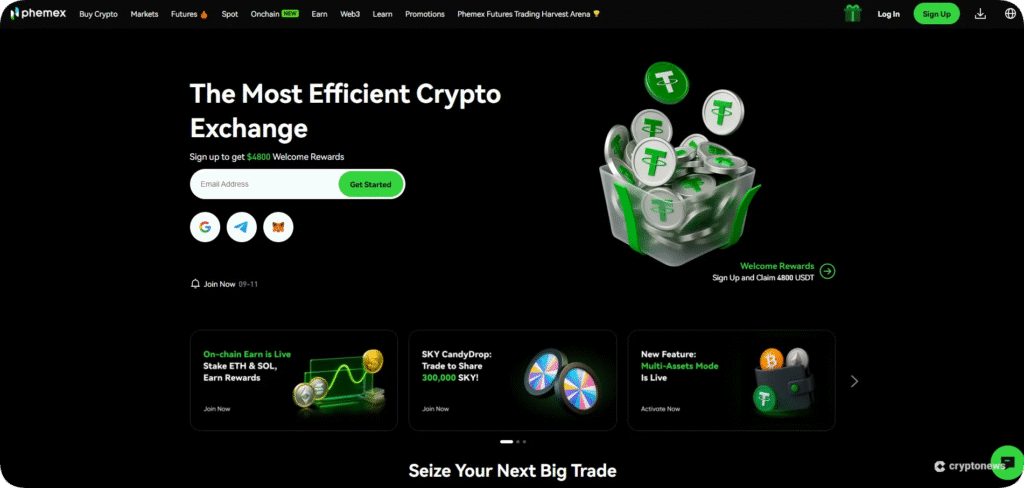

Phemex

- Leverage Options: Offers up to 100x leverage on certain contracts.

- Security: Employs industry-standard security measures including cold storage and two-factor authentication.

- Fiat Integration: Supports fiat deposits via credit/debit cards and bank transfers.

Risk Management Strategies

- Set Stop-Loss Orders: Automatically close positions at predetermined price levels to limit potential losses.

- Use Proper Position Sizing: Avoid over-leveraging by ensuring that each position size is appropriate relative to your account balance.

- Diversify Your Portfolio: Spread investments across different assets to mitigate risk.

- Stay Informed: Regularly monitor market conditions and news that could impact cryptocurrency prices.

Conclusion

Margin and futures trading in the cryptocurrency market offer significant opportunities for profit but come with increased risk. Choosing the right exchange is crucial, and platforms like Binance, Kraken, Bybit, KuCoin, and Phemex provide various features to cater to different trading needs. It’s essential for traders to employ sound risk management strategies and stay informed about market conditions to navigate these advanced trading methods successfully.

FAQ

What is the difference between margin and futures trading?

Margin trading involves borrowing funds to trade larger positions, while futures trading involves entering contracts to buy or sell an asset at a future date.

How does leverage work in crypto trading?

Leverage allows traders to control a larger position with a smaller amount of capital, amplifying both potential profits and losses.

Is margin trading suitable for beginners?

Margin trading can be risky for beginners due to the potential for significant losses. It’s recommended to gain experience with spot trading before venturing into margin trading.

Can I trade futures without owning the underlying cryptocurrency?

Yes, futures trading allows you to speculate on the price movement of cryptocurrencies without owning the actual asset.

What are the risks associated with margin and futures trading?

The primary risks include the potential for significant losses, margin calls, and the complexity of managing leveraged positions.

How can I manage risk in margin and futures trading?

Implementing strategies like setting stop-loss orders, using proper position sizing, and diversifying your portfolio can help manage risk.

Are there any fees associated with margin and futures trading?

Yes, exchanges typically charge fees for margin borrowing and futures contracts, which can vary between platforms.

Which exchange offers the highest leverage for crypto trading?

Platforms like Binance and Bybit offer up to 125x leverage on futures contracts, among the highest in the industry.

Can I trade crypto futures in the U.S.?

Yes, exchanges like Kraken and Coinbase offer crypto futures trading to U.S. residents, subject to regulatory compliance.

How do I get started with margin or futures trading?

Choose a reputable exchange, complete the necessary verification processes, deposit funds, and start by trading smaller positions to familiarize yourself with the platform and risks.

For those interested in enhancing their trading strategies and avoiding scams, integrating price action analysis with advanced tools like Quantum AI can provide a comprehensive approach to crypto trading.

Additionally, utilizing platforms such as Quantum AI can assist in identifying potential scams and making informed trading decisions.